When most people think of India’s pharma exports, they picture pills made for the U.S. or Europe. But the real story of growth today lies in emerging markets like Africa, Latin America, and Southeast Asia. These regions are transforming from peripheral destinations into strategic battlegrounds for India’s pharmaceutical giants. With soaring demand, rising healthcare access, and a hunger for affordable generics, Indian pharma firms are reimagining their playbooks.

Export Momentum: India’s Pharma Boom in Numbers

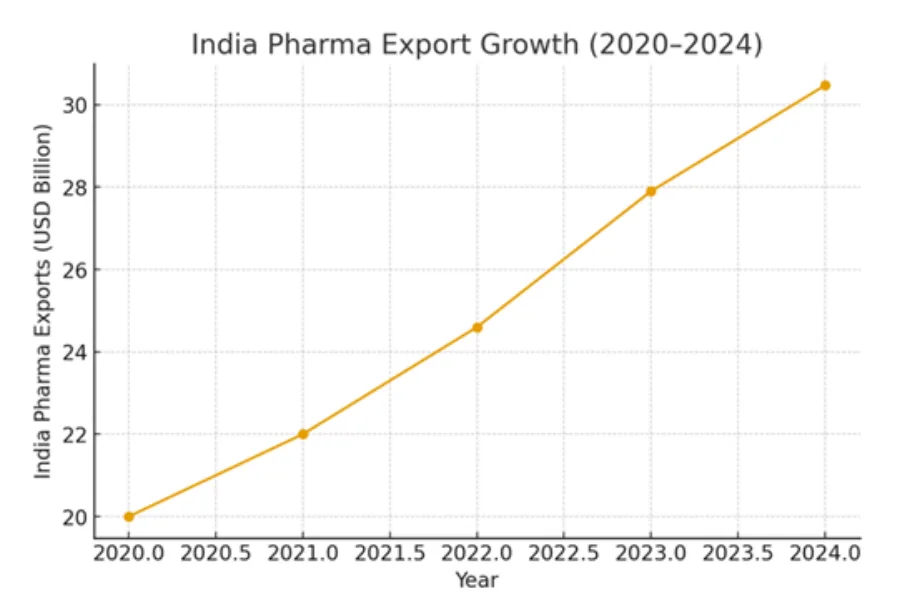

- In FY 2023–24, India’s pharma exports grew by 9.67% to USD 27.9 billion, according to commerce ministry data.

- In FY 2024–25, exports crossed USD 30.47 billion, marking a 9.40% increase.

- Category-wise, drug formulations & biologicals dominate, making up ~75% of total exports in FY 2023–24.

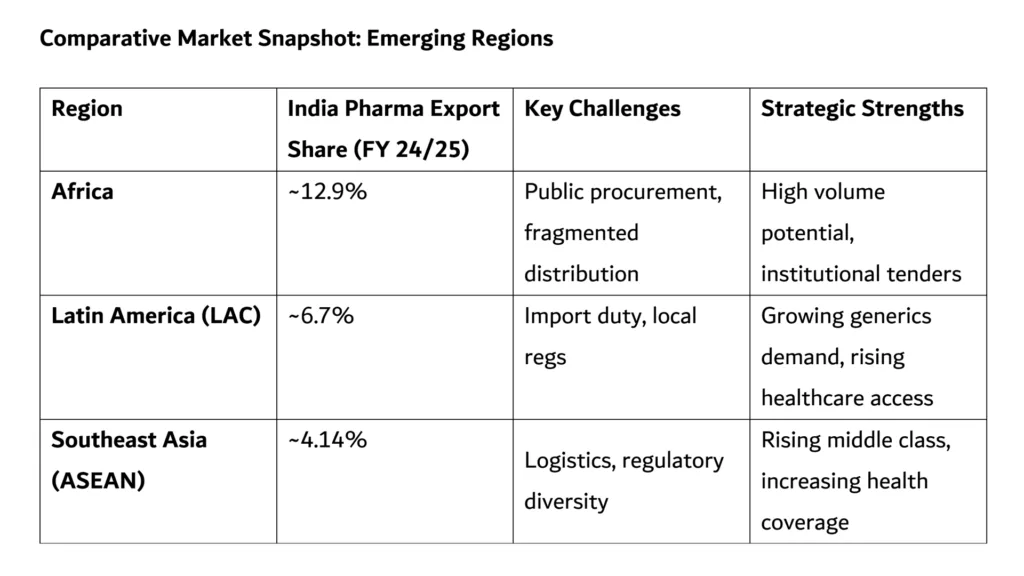

- Regionally, export share data for FY 2024–25 shows Africa at ~12.9%, Latin America & Caribbean (LAC) at ~6.7%, and ASEAN (Southeast Asia) at ~4.14%.

These numbers aren’t just growth, they are a clear signal: Indian pharma is spreading its wings beyond traditional markets.

India Pharma Export Growth (2020–2025)

India Pharma Export Growth (2020–2025)

A simple line graph tracing India’s pharma export value over five years: rising from around USD 20 billion in 2020 to over USD 30 billion in 2025. The chart shows steady year-on-year growth, underscoring the resilience and rising global demand for Indian-made medications.

Which Indian Pharma Giants Are Leading the Charge?

Some of India’s biggest pharmaceutical houses are already deeply embedded in emerging markets, not just exporting, but operating, manufacturing, and innovating there.

Here’s a snapshot of a few:

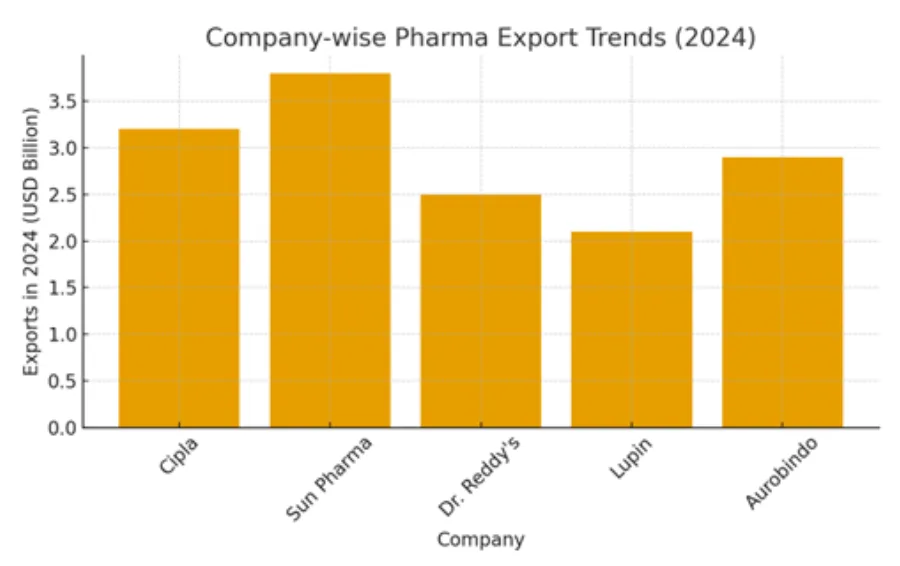

- Sun Pharmaceutical Industries: In FY 25, its emerging market formulations revenue grew to ₹ 94,160 million (~USD equivalent), up 9.2% year over year.

- Cipla Ltd.: While company-level export breakdowns are not publicly granular, Cipla has a presence in 80+ countries.

- Dr. Reddy’s Laboratories, Aurobindo Pharma, and Lupin are among other top Indian firms with strong global generics and branded-generic footprints.

Company-Wise Export Trends (2024)

Company-Wise Export Trends (2024)

A bar chart showing estimated export-oriented revenue (or export exposure) for leading companies: Sun Pharma, Cipla, Dr. Reddy’s, Aurobindo, Lupin. Sun Pharma leads, followed by Aurobindo, Cipla, Dr. Reddy’s, and Lupin, illustrating who is most export-driven among major Indian players. (Note: exact USD export values are not publicly disclosed, so this is a proxy based on international / emerging markets revenue.)

Strategic Challenges on the Road Ahead

Expanding into emerging markets is not risk-free. Here are the key hurdles Indian pharma firms must navigate:

- Regulatory fragmentation

Different countries demand different dossier formats; some insist on local clinical bridging, while others need WHO-GMP certificates, varying labeling, and local regulatory agents. - Price sensitivity & tender dynamics

In countries reliant on public procurement (especially in Africa and LAC), margins can be razor thin. Winning volume often means playing the tender game, not just competing on price, but on credit terms, delivery, and relationships. - Supply-chain complexity

Reaching remote areas requires robust distribution. Temperature-sensitive products (biologics, vaccines) demand reliable cold chains. Plus, partner management and serialization add layers of cost. - Quality perception & compliance risk

Indian companies have faced regulatory scrutiny. For example, over 36% of inspected manufacturing units were shuttered due to non-compliance, according to the Indian regulator. Quality lapses can jeopardize credibility in emerging markets. - Currency and macro risk

Dealing with FX volatility, import duties, and non-tariff barriers can erode profitability. And in politically unstable regions, policy shifts can drastically change demand dynamics.

GTM Strategy: A Framework for Emerging Markets

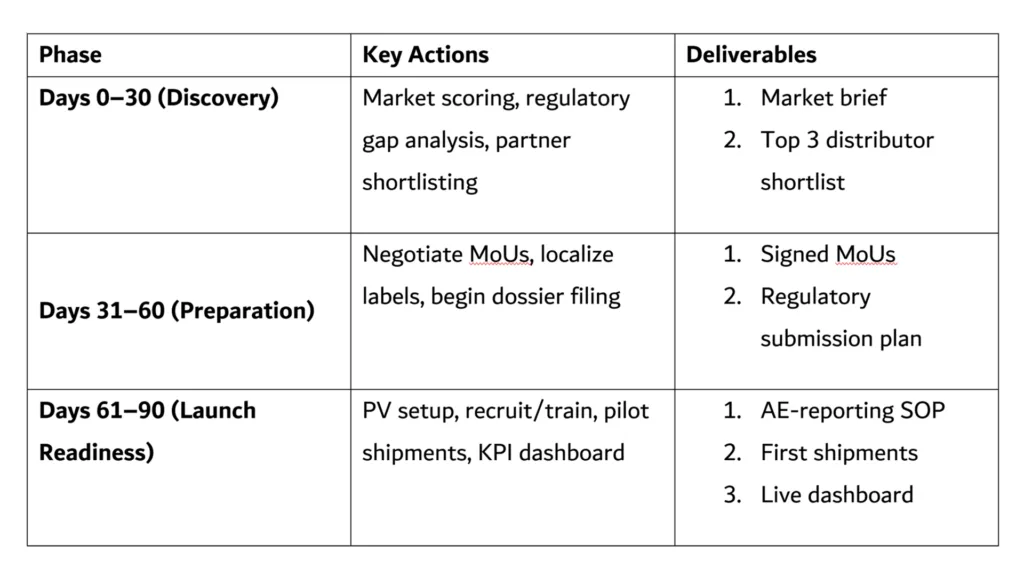

Here’s a refined go-to-market (GTM) playbook Indian pharma companies can use to succeed in emerging geographies:

Here’s a refined go-to-market (GTM) playbook Indian pharma companies can use to succeed in emerging geographies:

- Prioritization & Market Scoring

- Score markets on regulatory ease, demand potential, competitive intensity, and profitability.

- Use a 2×2 framework: Ease of Entry vs Market Potential. Start with one “quick win” market + one long-term bet.

- Regulatory Roadmap & Submissions

- Map out dossier requirements, local licensing needs, and PV (pharmacovigilance) obligations.

- Decide between full filing, reliance/abridged route, or working with a local MAH (Marketing Authorization Holder).

- Partner Strategy & Distribution

- Choose between distributor vs JV vs in-country affiliate.

- For public-procurement-heavy markets, build a dedicated tender team.

- Negotiate favorable credit terms, exclusivity, and responsibilities with partners.

- Supply Chain & Local Manufacturing

- Consider toll manufacturing, fill-finish locally to mitigate import duties and strengthen local presence.

- Build logistic infrastructure: warehousing, serialization, cold chain.

- Pricing, Market Access & Reimbursement

- Develop a robust commercial argument (cost + outcomes) for governments or insurers.

- Prepare local pricing dossiers, tender bids, or value-based proposals where relevant.

- Launch & Commercial Execution

- Hire a local sales force + medical affairs.

- Engage KOLs (Key Opinion Leaders), run educational programs.

- Localize marketing: translate materials, adapt to local clinical practices.

- Governance & Compliance

- Set up local PV systems to handle adverse event reporting.

- Define SOPs for complaints, recalls, and quality audits.

- Performance & KPIs

- Track: registration timelines, partner activation, first shipment, tender wins, margin trends, AE reporting metrics.

- Use dashboards with weekly operational, monthly commercial, and quarterly strategic reviews.

90-Day Launch Blueprint (Brazil + Nigeria Example)

Why This Approach Matters, And How You Can Help Companies Win

The global pharma landscape is being reshaped by shifting demand centers. For Indian companies, emerging markets are not just alternative export destinations, they are strategic battlegrounds where differentiation, cost leadership, and local partnerships can combine to unlock exponential growth.

The global pharma landscape is being reshaped by shifting demand centers. For Indian companies, emerging markets are not just alternative export destinations, they are strategic battlegrounds where differentiation, cost leadership, and local partnerships can combine to unlock exponential growth.

Conclusion

India has long been called the “pharmacy of the world,” but the next chapter is being written in places like Lagos, São Paulo, and Jakarta. The surge of demand, coupled with India’s manufacturing prowess, presents a generational opportunity, not just to sell more, but to build lasting partnerships, deepen global trust, and deliver affordable medicines where they are needed most.

As Indian pharma companies plot their next moves, those who merge thoughtful GTM planning with operational excellence will not only boost their bottom lines, they’ll fortify India’s reputation as a global healthcare backbone.

Citations